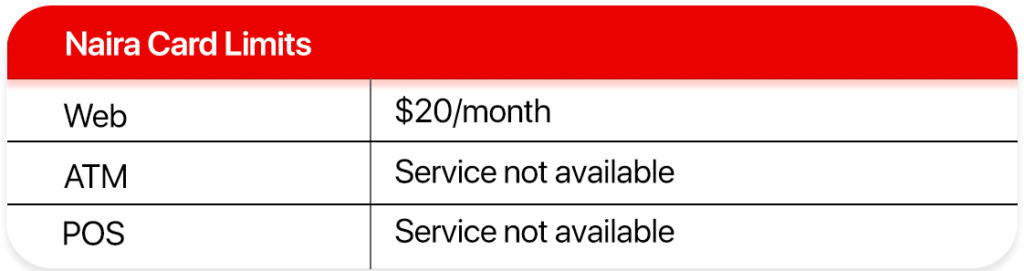

The International spending limits which was 100$ monthly on naira cards have been reviewed to as low as 20$. This happens to be the worse we have seen so far. Ideally, this 20$ limit can only be used to make payment for small services on Netflix, Spotify e.t.c so we were wowed when we got the update on this reviewed international spending limits.

United Bank of Africa (UBA) says it has lowered the international spending limit on its naira cards to $20 a month.

UBA disclosed this in the email they sent to their customer on Thursday;

According to the financial institution, the naira card will only be able to complete web purchases while POS and ATMs services will not work.

"In line with our promise to keep you updated on services, we have reviewed Naira Card limits for international transactions and this will take effect 1st of March, 2022"

What you should know!!

CBN the apex bank supplies other commercial banks with their FX demands, but the CBN reviewed its policy lately due to the shortage of FX reserves available.

The CBN reduced the quota sold to banks. The commercial banks have now passed this FX quota on their customers reducing limits as low as 20$ on their naira cards.

The implication of these drastic reductions is that; those that consume up to N50,000 on their cards will only have N10,000 to spend a month

If you can’t bear this latest development from banks, your best bet is to get a dollar card and fund it to make payments online. Although this comes at an increased rate. You buy dollars at the black market rate.